Content

The debate raged for years; in 1986, Representative Willem Vermeend estimated that the country’s tax service missed some ƒ4 billion per year due to companies such as The Rolling Stones’ holding bv’s using the “Caribbean route”. Profits earned by both public and private enterprises are normally subject to Corporate Income Tax. Foundations and associations may be required to file corporate income tax reports in specific circumstances. Certain types of income, however, can be exempted or excluded from the tax base.

Forty-four states and the District of Columbia levy a corporate income tax. Ohio, Nevada, and Washington tax corporations’ gross receipts instead of income. Texas levies a franchise tax on all businesses, including pass-through businesses, but excluding sole proprietorships.

Corporate and Pass-through Business Income and Returns Since 1980

You’ll need to contact your corporation’s bank to make arrangements to credit the state’s bank account with funds from your bank account. Find detailed instructions about initiating ACH Credit transactions in our Electronic Payment Guide. The hypothesis that there is no relation between the two variables cannot be rejected. Additionally, multivariate regression analysis shows that the estimated association between real GDP growth and the 1-year lag of the corporate tax rate is small and not statistically significant. In addition, specifications using a 5-year lag, a 10-year lag, and a 10-year distributed lag yield similar results with coefficient estimates that are not statistically significant. The U.S. corporate income-tax rate is also not high by historic standards.

- This basically means that the threshold for the first bracket remains at € 200,000.

- In the United States and Netherlands, among others, this is accomplished by filing a single tax return including the income and loss of each group member.

- Where such interest is paid to related parties, such deduction may be limited.

- Most jurisdictions tax corporations on their income, like the United Kingdom or the United States.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Corporate taxes are collected by the government as a source of income. Our tax advisors will be only too glad to help you or your accountant, whether your company is established in the Netherlands or abroad. Get expert advice anywhere in the world on national and international taxation. Note that the rate applicable to a majority of industries is used for heat map purposes if rates are industry-specific. If rates are based on resident status, then the resident rate is used for heat map purposes.

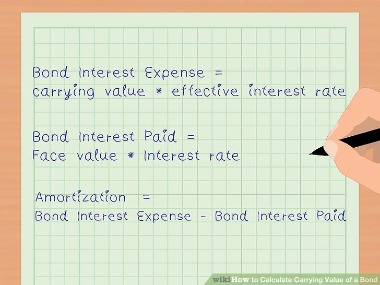

Corporate Income Tax (1120ME)

Exploring how race, ethnicity, and class intersect to affect economic outcomes in the United States. For the first 10 years, there is a transitional rule where the substance carve-out starts off at 8% of the carrying value of tangible assets and 10% of payroll costs. For tangible assets, the rate declines annually by 0.2% for the first five years and by 0.4% for the remaining period. In the case of payroll, the rate declines annually by 0.2% for the first five years and 0.8% for the remaining period. All revenue data are from the US Census Bureau’s Annual Survey of State Government Tax Collections. All dates in sections about revenue reference the fiscal year unless stated otherwise.

As of January 2023, only four states used the traditional three-factor formula, while 29 states and the District of Columbia used only sales in their apportionment formula. The remaining states use property and payroll in their formulas but give greater weight to sales. By using the portion of a corporation’s sales rather than employment or property to determine tax liability, states hope to encourage companies to relocate or to expand their production operations within the states they operate in. State governments collected $52 billion in revenue from https://kelleysbookkeeping.com/es in 2020, or 2 percent of state general revenue.