Content

You may also want to see if any numbers have been transposed or entered in the wrong column, such as a debit entry inadvertently posted as a credit. Double entry is an accounting term stating that every financial transaction has equal and opposite effects in at least two different accounts. Accounting is the process of recording, summarizing, and reporting financial transactions to oversight agencies, regulators, and the IRS.

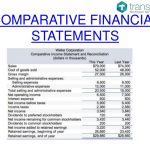

These columns should balance, otherwise, it would likely mean that there has been an error in the posting of the adjusting entries. This is one of the last steps in the period-end closing process. As balance sheet entries are listed in the trial balance, it is done similarly to the balance sheet with first assets, then liabilities, and then equity. Both the debits and credit totals a post-closing trial balance will show: are calculated at the end, and if these are not equal, one can know there must have been some mistake in preparing the trial balance. Because you made closing entries for revenue and expenses, those accounts do not appear on the post-closing trial balance. You’ll also notice that the owner’s capital account has a new balance based on the closing entries you made earlier.

Example Post-Closing Trial Balance

All account with a debit balance will be listed on the debit side of the trial balance and all accounts with a credit balance will be listed on the credit side of the trial balance. All three of these types have exactly the same format but slightly different uses. The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed.

Running a trial balance is a must for anyone manually recording financial transactions since it helps to make sure that debits and credits are in balance — which is the core principle of double-entry accounting. The key difference between a trial balance and a balance sheet is one of scope. A balance sheet records not only the closing balances of accounts within a company but also the assets, liabilities, and equity of the company. It is usually released to the public, rather than just being used internally, and requires the signature of an auditor to be regarded as trustworthy.

Requirements for a Trial Balance

Temporary accounts like revenues, expenses, and distributions have to be closed at the end of each accounting period to permanent accounts like assets, liabilities, and equity. The post closing trial balance lists all remaining accounts with balances after the closing entries have been posted to ensure that no temporary accounts still exist. Another thing to observe is that as expected we do not see any temporary account balances in the post-closing trial balance.

- Although it is not a part of financial statements, the adjusted balances are carried forward in the different reports that form part of financial statements.

- The post closing trial balance lists all remaining accounts with balances after the closing entries have been posted to ensure that no temporary accounts still exist.

- Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year.

- If there are any temporary accounts on this trial balance, you would know that there was an error in the closing process.

- Rebekiah received her BBA from Georgia Southwestern State University and her MSM from Troy University.

- As we can see from the above example, the debit and the credit columns balances are matching.

The general purpose of producing a trial balance is to ensure that the entries in a company’s bookkeeping system are mathematically correct. In a double entry accounting system, accounts are entered in either a debit or credit column. Accounts are debited to show an increase in an asset, expenses and receivables. Accounts are credited to show an increase in revenue or liabilities. Your debit amounts always have to equal your credit amounts, which is one of the reasons to prepare a post-closing — or after-closing — trial balance.

of Numerade Students Report Better Grades

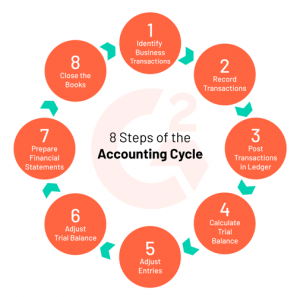

The post-closing trial balance is the report that lists all the accounts of a company and their balances after all adjustments and closing entries have been made. The creation of the post-closing trial balance is the last thing that occurs at the end of an accounting cycle. The accounts will show debits which is money coming in and credits which are charged transactions. The post-closing trial balance shows the end balance on all permanent accounts listed on the business ledger.

A post-closing trial balance is a trial balance made at the end of the period to verify that the total debits and total credits are equal. This is the last step in the accounting cycle made at the end of the period. The last thing that occurs at the end of the accounting cycle is to prepare a post-closing trial balance. Another peculiar thing about Bob’s post-closing trial balance is that normally a retained earnings account will have a credit balance, but in Bob’s books it has a debit balance. The reason is that Bob did not make a profit in the first month of his operations.

The Post-Closing Trial Balance

The first step is to collect all accounts under one trial balance sheet for Consulting Company Incorporated. Below is an example of a business accounting team using post-closing entries in their accounts. Adjusted Trial BalanceAdjusted Trial Balance is a statement which incorporates all the relevant adjustments. Although it is not a part of financial statements, the adjusted balances are carried forward in the different reports that form part of financial statements. A post-closing trial balance checks the accuracy of the closing process. However, if that’s not the case, look at your subsidiary ledgers to make sure that all of your transactions have been properly posted.